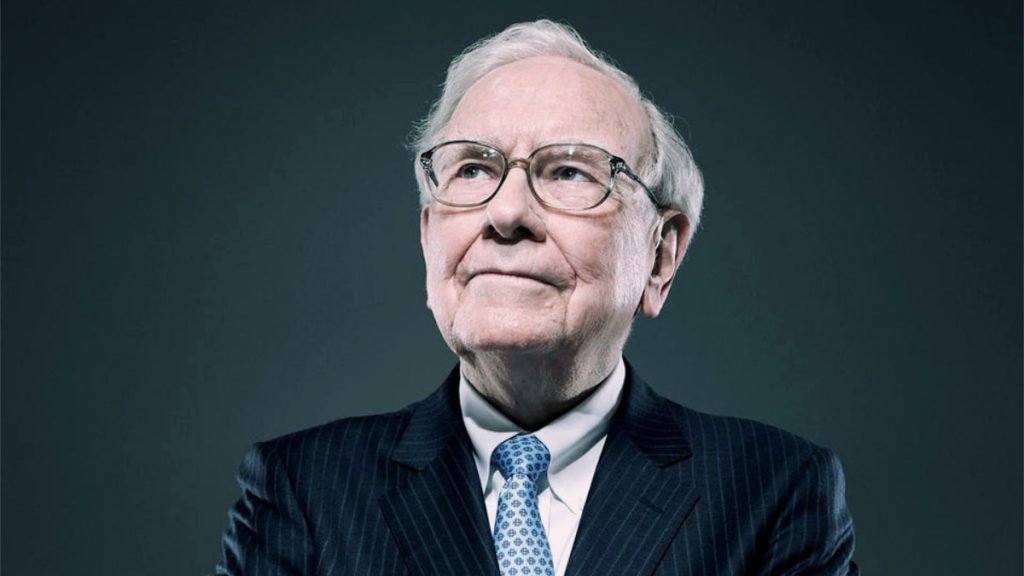

Warren Buffett: a legendary figure in the world of finance

Warren Buffett, fundador de Berkshire Hathaway y pionero en la inversión en valor.

Across the globe, Warren Buffett is acclaimed as one of the most successful and respected investors. Known as the “Oracle of Omaha,” he has amassed a vast fortune through his investment acumen and long-term vision for building successful companies. This article takes a closer look at who Warren Buffett is and what has made him a legendary figure in the world of finance.

Origins and career

Warren Buffett was born in Omaha, Nebraska, in 1930. He showed a talent for business from a young age and was already investing in the stock market as a teenager. He studied at the University of Nebraska, earning a degree in business, and later completed a master’s at Columbia University in New York.

Buffett began his financial career as an investment salesman but quickly realized he had a gift for picking stocks. In the early 1950s, he founded his own investment partnership and over the next decades built a reputation as one of the world’s most successful investors. In the 1960s, he became a major shareholder in the textile company Berkshire Hathaway, eventually taking control of the firm in 1965.

Under Buffett’s leadership, Berkshire Hathaway grew into a major business player, with interests across a wide range of industries, including insurance, retail, and manufacturing. Buffett is known for his long-term investment approach and his ability to identify companies with strong growth potential that are undervalued by the market. He is also famous for his down-to-earth personality and commitment to a simple, frugal lifestyle.

The value investing approach

Over the years, Warren Buffett has become one of the richest people in the world, with an estimated net worth of more than $100 billion. However, he is also one of the most generous, having pledged to donate the majority of his fortune to philanthropic causes. In 2010, together with fellow billionaire Bill Gates, he launched The Giving Pledge, an initiative encouraging the world’s wealthiest individuals to give at least half their wealth to charity.

What sets Warren Buffett apart from other successful investors is his value investing philosophy. This approach involves identifying companies that are undervalued by the market and investing in them for the long term. Buffett is known for spotting companies with strong fundamentals, such as consistent earnings growth, high return on equity, and sustainable competitive advantages. He looks for companies with a “moat”—a lasting edge that protects the business from competitors.

Buffett is also well known for his annual letters to shareholders, in which he shares insights on investing, business, and life. These letters are a rich source of wisdom and are eagerly awaited by investors around the world.

Warren Buffett’s philanthropy

Despite his immense wealth and success, Warren Buffett has remained grounded and humble. He still lives in the same modest house he bought in the 1950s and eats at the same fast-food restaurants he’s always enjoyed. He has said that he measures success not by how much money he has, but by how many people love him.

In addition to his business achievements, Buffett is widely recognized for his philanthropic efforts. He has donated billions of dollars to a wide variety of causes, including education, healthcare, and poverty reduction. He has also been an outspoken critic of income inequality and has advocated for higher taxes on the wealthy.

In conclusion, Warren Buffett is one of the most successful and respected investors in the world, and his legacy will continue to inspire generations of investors and entrepreneurs. His focus on value investing, commitment to a simple and frugal lifestyle, and extraordinary generosity have made him a role model for millions.